Impact on the Global Economy

In recent weeks, global oil prices have surged dramatically, a trend that has significant implications for economies worldwide and for consumers. As crude oil prices reach new heights, it’s crucial to understand the factors driving this increase and its potential impact on your daily life and the broader economic landscape.

The Surge in Oil Prices: An Overview

Crude oil prices have recently seen a sharp increase, driven primarily by supply cuts from major oil-producing countries. Saudi Arabia and Russia, two of the world’s largest oil exporters, have announced significant reductions in their oil production levels. This move, aimed at stabilizing or boosting oil prices, has led to a ripple effect across global markets.

Key Factors Driving the Increase

Production Cuts: Saudi Arabia and Russia’s decision to cut oil production by over a million barrels per day has tightened supply. This strategic move is designed to reduce market oversupply and drive up prices.

Geopolitical Tensions: Ongoing geopolitical tensions, particularly involving major oil-producing regions, have added to market uncertainty. This includes conflicts and trade disputes that can disrupt oil supply chains.

Economic Recovery: As global economies recover from the COVID-19 pandemic, demand for oil has surged. This recovery has outpaced the supply, exacerbating the price increase.

Impact on the Global Economy

Inflationary Pressures: Rising oil prices contribute to higher transportation and production costs, which can lead to increased prices for goods and services. This inflationary pressure affects both consumers and businesses.

Energy Sector Profits: Oil companies are seeing increased profits due to higher prices. This can lead to more investment in the energy sector but may also result in volatility if prices fluctuate significantly.

Economic Slowdown Risks: Prolonged high oil prices can slow down economic growth, particularly in oil-importing countries. Higher fuel costs can reduce consumer spending and increase production costs for businesses.

Implications for Consumers

Increased Fuel Costs: One of the most immediate impacts of rising oil prices is the increase in fuel costs. Drivers may notice higher prices at the pump, affecting their daily transportation expenses.

Higher Cost of Goods: As transportation and production costs rise, the prices of goods and services may increase. Consumers may experience higher grocery bills, more expensive travel, and increased costs for other goods.

Energy Bills: For those who use oil for heating or other purposes, energy bills are likely to rise. This can have a significant impact on household budgets, particularly in colder regions where oil is a primary heating source.

.What Can Be Done?

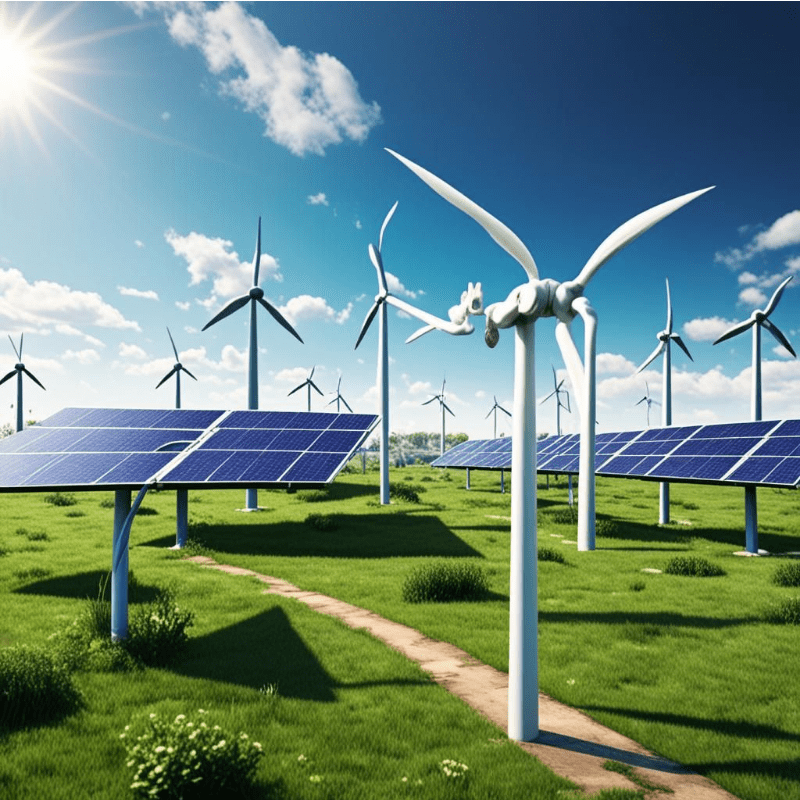

Energy Efficiency: Consumers can reduce their reliance on oil by adopting energy-efficient practices and technologies. This includes using energy-efficient appliances, reducing driving, and considering alternative energy sources.

Diversification: Businesses can explore diversifying their energy sources to mitigate the impact of fluctuating oil prices. Investing in renewable energy can provide long-term stability and cost savings.

Monitoring Trends: Staying informed about global oil market trends can help consumers and businesses anticipate price changes and adjust their budgets accordingly.

The surge in global oil prices is a complex issue with far-reaching consequences. While it presents challenges for consumers and the broader economy, understanding the factors at play and exploring strategies to mitigate its impact can help navigate these turbulent times. As oil prices continue to fluctuate, staying informed and proactive will be key to managing both personal and business financial health.